/bmi/media/post_banners/4ad7855e7de12b843756f19f7e3b2171d274860cb328ab85858b9ab518a9ec35.jpg)

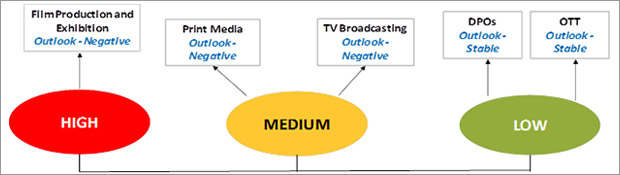

The Covid-19 outbreak has impacted the domestic media and entertainment industry in a varied manner, comprising film production and exhibition, print media and television (TV) broadcasting segments, besides distribution platform operators (DPOs) and over-the-top (OTT) platforms.

ICRA, the independent and professional investment Information and Credit Rating Agency, has a negative credit outlook for the film production and exhibition, print media and TV broadcasting segments of the Indian Media and Entertainment (M&E) industry. Besides the direct impact by way of lost sales due to the shutdown of cinema halls, given the adverse impact on the overall economy, sharp reduction in advertisement spends has been observed in April and May 2020, and is expected to continue over the short term. This, in turn, will dampen the revenues and profit margins of these segments of the Indian M&E industry in FY2021.

Sakshi Suneja, Assistant Vice-President, ICRA, said, “Cinema halls were the first ones to shut down, even before the lockdown started, and are expected to be among the last segments to witness relaxations. This segment will thus witness a complete loss of revenues in Q1 FY2021. Even after the theatres resume operations post the lockdown, occupancy is expected to remain sub-par as consumers, as a means of caution, are likely to stay away from crowded places. Corporate advertisement spends will witness a decline, adversely impacting the advertisement revenues of film exhibitors. Overall, ICRA estimates a 60-65% YoY degrowth in revenues in FY2021 for the entities engaged in the film exhibition industry. Furthermore, low footfalls once cinema halls resume operations will result in lower box-office collections, adversely impacting the revenues of the film producers.”

Around 40-45% of the total cost of the film exhibitors (primarily multiplexes) is fixed in nature, with lease rental being the major component accounting for 20-22% of the total cost. To minimise the impact on losses and cash outflows, most of the multiplexes have invoked force majeure clauses in their rental agreements, so that they do not have to pay rental and common area maintenance (CAM) charges during the period of lockdown, and are also negotiating a variable rental structure with the mall owners, once the operations resume. Salary rationalisation and pay cuts have also been undertaken by the exhibitors. Overall fixed expenses have been curtailed on an average by 2/3rd (of earlier levels) during the Covid-19 pandemic.

ICRA expects the credit metrics for the players in the film production and exhibition segments to weaken materially, though ICRA-rated portfolio has a healthy credit profile.

For the print media segment, circulation revenues were adversely impacted by ~40% on YoY basis in April 2020, amid distribution challenges due to the lockdown restrictions. Furthermore, advertisement revenues, which were already under pressure during FY2020 amid subdued economic conditions, declined by ~60-70% YoY in April 2020.

Advertisement revenues have also been adversely impacted for the TV broadcasting segment in April 2020. While news and movies genre are on the lower end of the spectrum, with an average decline of 25-30% in advertisement revenues (vis-a-vis average monthly revenues), general entertainment channels (GECs) and sports channels have witnessed a sharp 55-60% reduction in advertisement revenues in April 2020. This is in turn explained by the absence of fresh content (given the shutdowns and travelling restrictions) and deferment of high viewership driving sports events. Subscription revenues, comprising 30% of the total revenues of TV broadcasters, are, however, holding steady as consumers have increased their TV viewing (led by movies and news genre) during the lockdown.

Kinjal Shah, Vice-President, ICRA, said “Weakened advertisement revenues will moderate the revenues and profit margins for entities engaged in the print media and TV broadcasting segments in H1 FY2021, though some recovery in advertisement revenues is expected in H2. Expected normalisation in circulation revenues for the print segment in coming quarters as lockdown restrictions ease and low newsprint prices are some positives. For the TV broadcasters, steady state subscription revenues will provide some shield to revenues. However, fresh content production remains a key challenge. We expect the credit metrics of entities engaged in the print media to weaken in FY2021, though ICRA-rated entities have strong liquidity to weather the impact. The TV broadcasting segment will also witness moderation in credit metrics. The credit outlook for both these segments is negative.”

ICRA has a stable outlook on the DPOs and the OTT platforms. The impact of the pandemic on the DPOs will be limited as subscribers are expected to hold on to their current subscription packages. New subscriber acquisitions have, however, been impacted as very few new installations are being carried out by DPOs, though it is expected to resume once the lockdown restrictions ease. Prolonged lack of fresh content from TV broadcasters may, however, increase subscriber churn towards DD Free dish.

The current lockdown has led to a surge in consumption of OTT platforms as consumers stay home. While currently OTT platforms have an advertisement revenue-dominated business model, the current crisis provides an opportunity to increase the proportion of paid subscription, led by the new habit formation of at-home OTT viewing. Furthermore, with the shutdown of cinema halls and expected aversion to outdoor viewing of films, OTT (especially large platforms) are also being considered by the film producers for their film releases. A shift in advertisers’ preference towards online platforms (vis-a-vis linear platforms) is also expected as they attempt to garner more eyeballs and especially, after the deferments and cancellations of various sports programmes, which were to be aired on linear TV. OTT platforms, however, are also facing dry up of fresh and quality content. Platforms with large content library are thus better placed to ramp up subscribers during the current crisis.

Exhibit 1: Credit Outlook for various segments of the Indian M&E industry

Source: ICRA research

/bmi/media/agency_attachments/KAKPsR4kHI0ik7widvjr.png)

Follow Us

Follow Us